Now that you’ve built up a strong business that is successfully growing, you’re moving into the final stage of the business lifecycle: selling. No matter if you’re selling because the market is right or you’re just ready to pass the torch, you need to be prepared to sell and should thoroughly explore the options so you can make the best decision for you and your business.

Prepare

There are a lot of directions to look when you’re getting ready to sell your business. As a business owner, it’s important that you get prepared so you know what your business is worth and sell for top value.

Understanding Trends

Explore your niche’s market trends and business sale trends. These can be important factors in your negotiation and business valuation. If your niche’s outlook and the industry’s environment are rosy, then you might be in a strong position to receive a higher valuation. This occurred during covid for ecommerce. All of a sudden, everyone was home and buying online. Having an ecommerce business was sexy and the outlook was good. Aggregators raised tons of money. People were shopping for businesses. All of this drove up valuations. Things have gotten a little softer lately, so valuations have decreased a bit. Timing is everything.

Clear SOPs

This may sound like a broken record, but we cannot understate the importance. At some point there will be a new owner and a new team that needs to run the business. If you’ve built a business that comes with an instruction manual, your business will be worth more. Another way to think of this is: you want to have a turnkey business. It’s one that can begin operation under a new owner with just a turn of the key.

With clean and clear SOPs, the new owner can just follow the steps/checklist/process. Life in the business can go on without you being in the middle of it, pulling the machine’s levers. Here’s a good write up for “How to Write Effective Standard Operating Procedures”. Spend time on this now – you will be happier and less stressed during the transition to new owners.

Where’s Your Inventory?

If you haven’t been on top of inventory and where each order is in the supply chain, now is the time. The future buyer of your business will be purchasing your inventory – most likely at cost. However, if you lose track of some inventory, you might not get fully compensated, so take the time to identify all inventory throughout the business. As mentioned in a prior post, look for (and document) the following:

- Inventory deposits for manufacturing

- Inventory that is in transit (on the boat, in the air, on a truck)

- Inventory that’s available for sale

- Do you have units at your home office? Or in your warehouse?

- With a 3PL?

- With a sales channel partner (i.e. storage at Amazon FBA)?

Also, ensure you understand the cost of each SKU. There might also be different purchase prices – maybe your costs went up or down between orders. You’ll need these critical details as you get into conversations with brokers or buyers.

Structuring the Books for Sale

Sometimes, owners have business expenses that aren’t essential to running the business. Owner salaries might fall into this bucket – or something like a magazine subscription. Additionally, there can also be one-time expenses that won’t reoccur for future business owners (ex: project implementation costs, consulting expenses, product molds for a SKU). These expenses are sometimes called Add Backs or Seller Discretionary Expenses.

Basically, these expenses won’t necessarily impact future cash flow for a future owner. So, we “add back” these expenses into income to get a true picture of what really happened in the business. Your Profit & Loss Statement accounts can be structured in a way that provides you and potential buyers with an accurate business sales view and an easy way to crunch the numbers. It’s best to do this exercise early on – and even before you decide to sell. Looking at the trailing 12 months of Operating Profit and Add Backs will give you an indication of what you can expect for business valuation.

Understanding When to Sell

You also need to be mindful of your business’ storyline. Are you selling when your sales are growing, or decreasing? Has your business been stagnant and just plodding along in a steady state for a while? If your trailing 12 months shows a strong picture – things are looking up and the business is growing – you’ll have a strong story to tell buyers. Also, if things don’t look that great on paper, it could also be a good opportunity for buyers to buy at a lower price and get a higher return on their investment by turning things around.

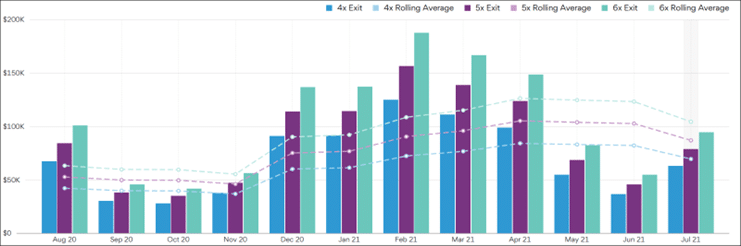

Timing also plays a role in your decisions. Here’s a 12-month example of each month’s potential contribution to a total sales price. October 2020 had lower results. If October 2021 was going to be much better than 2020, waiting until October 2020 falls off the trailing 12 months may be a smart move for your valuation.

Personal factors also come into play. Sometimes a business sale process is accelerated because of things like divorce or death or debts. While it’s always better to sell from a strong position, sometimes it cannot be helped. However, when your to-do list includes work on the factors and bullet points covered in this blog series, it might mitigate negative circumstances. Sometimes the business sale comes about because you’ve hit “your number” and you’re ready to cash out and start a new adventure!

Legal & Tax Advice

While advice from lawyers and CPAs can be beneficial throughout the business lifecycle, it’s really important to have them on your roster during the sales process. You’ll get feedback on sales timing, sales structure, tax implications, negotiation, and contracts – with advice on how to best meet your goals and targets. Yes, explore legal and tax advisors – but also make sure they have experience in selling businesses. For example, there are many different niches and types of lawyers – you wouldn’t necessarily want a lawyer who only has experience with constitutional law. You want someone who’s been involved with selling businesses and can guide you around pitfalls and issues!

Explore

Once you’ve got all your ducks in a row, and the business is ready to be sold, it’s time to do some research. You need to decide how and when to sell, and how much to sell for.

Sales Price Evaluation

Ultimately, the business is worth what someone will pay for it. If you need the money yesterday, you might need to price-to-sell and run with a lower sales price. If you aren’t in a rush, you might decide to price higher and wait for the right number. You just can’t ignore the bigger picture – as mentioned above, the “story” of the business will also play a major role (increasing vs decreasing sales and profits, etc).

There are other factors that should be considered, for example: profits, trends, age of the business, assets (like intellectual property, inventory, equipment, etc.) All of this gets rolled together along with the Add Back / Exit Metrics we discussed above. Often, a multiplier will be applied to get to a proposed sales price. First, the operating profit (OP) and the add-back total (AB) are summed together. Looking at the trailing 12-month total, we can then apply a multiplier. (The multiplier will often be influenced by the overall market – for example, while we were knee deep in the pandemic, multipliers were a bit higher.)

In this example screenshot, the 12-month total was $208,852. Multiply by 4, 5, and 6 to get the respective valuation estimates.

There are other valuation methods, but you’ll probably find this method is pretty popular.

Broker vs DIY

Some choose to head down the “for sale by owner” path. Yes, you’ll save the commission money, but you’ll have other costs – legal, tax, maybe an independent sales advisor. On this path, you should definitely have your own advisors ready! However, a broker can add a lot of value to the process. They have visibility into behind-the-scenes activities, they might have vetted buyers ahead of time, and many have been-there-done-that with other sellers and can provide supportive guidance during times of stress.

It all comes at a (varying) cost, depending on the size of the deal. Sometimes a broker commission can be 15% of the deal. For example, check out the Empire Flippers cost structure which has different ranges based on sales price.

How Much Do You Need?

It’s important to have clarity on how much you need to clear from the sale. If you go into the sales process knowing what “your number” is, you’ll be in a data-driven position of strength. You’ll be able to more easily evaluate offers and negotiate. As part of your preparation, run an exercise allocating some of the proceeds to:

- Paying off/down business debts – loans, credit cards

- Taxes – even though you might not need to pay the IRS right at the sale, you should plan to move money to a separate bank account so you know you’ll be able to cover the bill at tax time (talk strategies and amounts with your CPA!)

- Broker commissions or advisor fees

- Retirement / Investments (via the business) – if you have a SEP IRA or something similar, maybe this is a good time to contribute?

Once you’ve worked out the items above, how much do you need for personal expenses/savings such as:

- Retirement / Investments – if you don’t have something like a SEP plan, you might put money towards a Roth IRA

- Paying off/down personal debts

- Think about future expenses: college savings, family expenses, home remodels, etc

- Don’t forget to celebrate a little – maybe putting some towards a vacation!

- Craft The Presentation

Time to craft your story! There’s the narrative about you and your business, and there’s also the financial story. For your narrative, think about the following:

- When and why did you create your business? Why are you selling? How much time do you spend per week?

- Are you the only worker or do you have employees/contractors? If so, what do they do?

- Are you selling the whole business or just the assets?

- Discuss pitfalls or hiccups or things that might look bad before the buyer brings it up. Offer ideas and suggestions. Talk about opportunities.

For the financials, think about the following:

- Are sales increasing or decreasing? How about costs?

- Discuss the trends and portfolio level profit margins.

- Understand metrics like COGS and advertising as a percent of revenue.

- Know the product level profitability of your top-selling SKUs.

- The work you completed on your add-back analysis, and knowing what expenses won’t move forward with business, will come in handy too!

Don’t forget that you also need to evaluate the buyer as well.

- What’s the likelihood of closing the deal?

- Where is the buyer’s cash coming from?

- Is their moving forward contingent on anything else falling in place for them?

- What’s their plan with the business?

Once you have everything cleaned up and ready for the market, and decided how to go about getting your business sold, you’re prepared to put your listing out there. Next week, we’ll end the SmartCFO series talking about the final sale and how to ensure an easy transition to the new owner so that you can take a smooth exit.

If you’re ready to sell, or just want to have a clean start, bookskeep can help! Reach out to the team today!

Do you know about Cyndi’s new book?

Motherhood, Apple Pie and all that Happy Horseshit

“You’re about to discover the recipe for successful momma entrepreneurs.”

Business is Personal

As a Mom, you can have it all and it’s better when you do. Using your personal values to create the business of your dreams. By the end of this book you’ll be confident in designing a business that supports your family and yourself. Order Now!

Interested in Profit First?

You can also sign up for the Profit First for Ecommerce Sellers Online Course. As a Mastery Level, Certified Profit First Professional, I will teach you why Profit First works so well for ecommerce businesses and the particular challenges for businesses that have physical products requiring inventory management. You will learn how your behavior drives your money management habits for your business and how you can set up your business bank accounts to work with your habits.

Check out all our ecommerce accounting and profit advising services here!

Leave a Comment