Ecommerce Business Growth is Complex

As an ecommerce business owner, you recognize the complexities of the business model. Making critical decisions about supplier relationships, inventory forecasting, and advertising campaigns can be overwhelming. Our SmartCFO service was developed with your specific challenges and needs in mind.

SmartCFOs Understand Small Business

You need a SmartCFO that understands small business challenges and the limited time and money available to solve them. Traditionally, a corporate CFO devours mountains of paper, and sets budgets for people and projects for organizations with over $50 million in revenue. A SmartCFO understands that your problems have strong ties to your personal goals and finances.

Focus on the Next Critical Steps

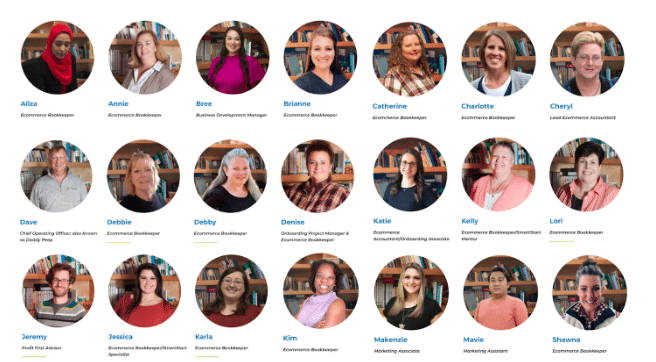

Since 2014, our team at bookskeep has guided ecommerce businesses toward their goals of profitability, debt reduction, growth and ultimately a successful exit. Our small business and ecommerce business experience allow us to zero in on what’s important right now for your business and your life.

Ready to transform your ecommerce business and achieve the business that supports your life?

Get Started in Three Easy Steps

Click The Button Below and Schedule Your Call

Discuss Your Specific Challenges and Goals

Choose the Perfect Solution For Your Business

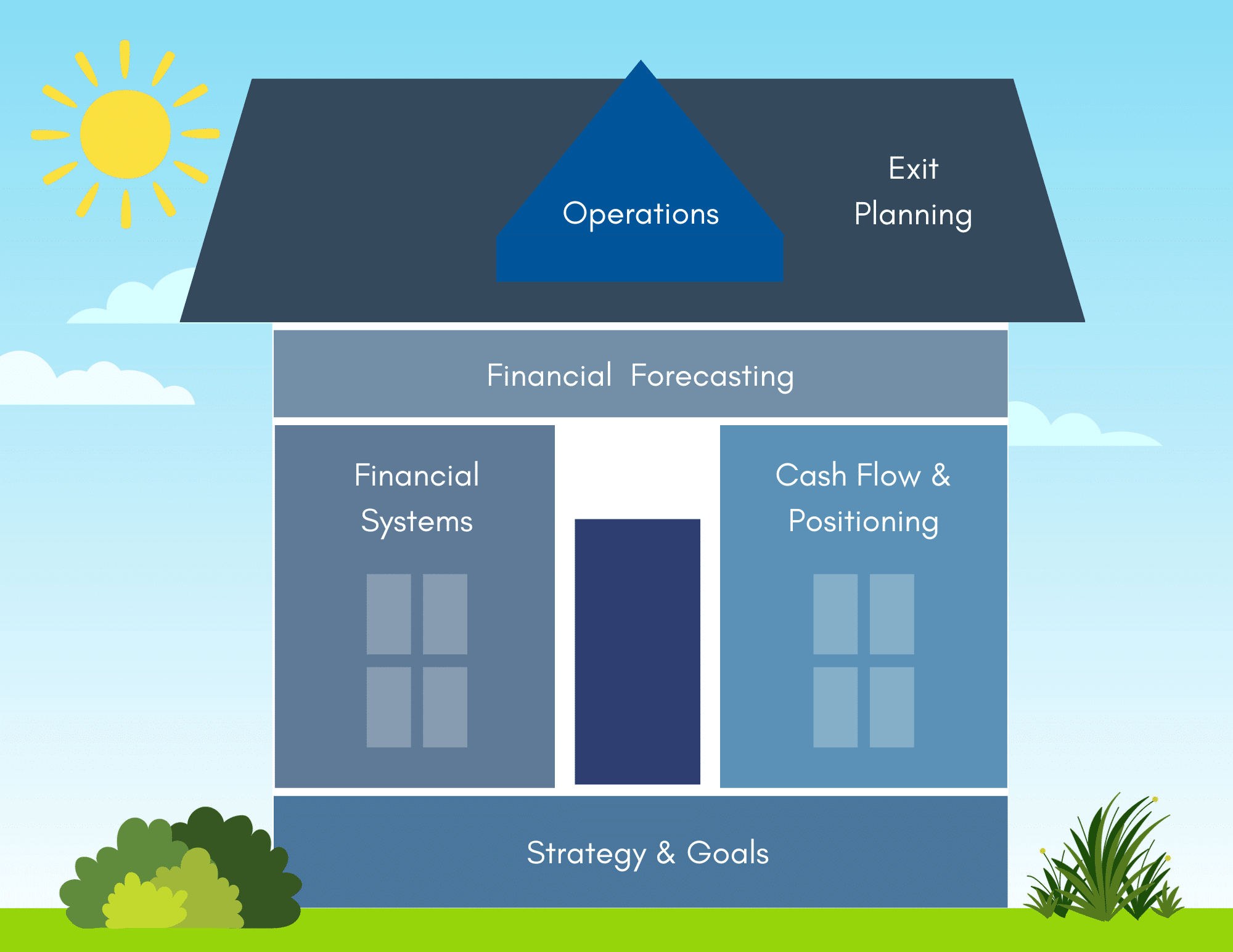

The Six Main Elements of Ecommerce Business Success

Strategy & Goals

Your business should support your life. That’s why our mission is to help clients increase profits, reduce debt, and grow and/or sell. We know your financial health is vital to your business health and for the family life you are striving to create.

Financial Systems

By understanding the key numbers in your business, you can cut through the noise and focus on what the numbers are telling you. This understanding is the key to taking action and making the right decisions going forward.

Cashflow Positioning

Every dollar should be put to work in your business. Understanding how individual product sales contribute to cash intake and how expenses can either drain or add a nice return is vital.

Financial Forecasting

At bookskeep we use multiple tools to forecast financial results. We also help clients review the profitability of future product ideas through projected product profitability analysis.

Operations

Being in command of your time puts you in command of your operations. Once you have your cash flow humming, we can guide you as you tackle those operational issues, so you can direct the business in ways that make it work for you.

Exit Planning

Having confidence in your numbers sets you up to get the price you set because you are prepared. You want to ensure all your financial and operational systems are humming to generate the most value possible when you exit.

Take the short Business Performance SmartAssessment to see

how your business is performing in each of these areas.

SmartCFO Blueprint

Clarity and focus on your goals and how to measure success

Books that help you make better management and cashflow decisions

Profit First Assessment – to predict issues BEFORE they happen

Get expenses under control and start giving yourself a paycheck

Learn to read your financials for warning signs of trouble

Have a rainy-day fund for unexpected events

Identify and manage to the KPI’s that increase profit and security

Get paid consistently from your business

Be clear on what product and marketing actions are most profitable

Sleep soundly with clear financial forecasts

Hire help and get back your time

Get back to fun by removing the stress and debt and uncertainty

Maximize profitability with intentional inventory and advertising management

Maximize Profit First to keep your business healthy