Congratulations! You have figured out how to sell on Amazon and are now making a little profit. What’s next? How can you scale and grow your profits so you can be confident in this income stream so you can leave your day job or eventually sell your amazon business? Maybe you’re not sure what to do first.

Let’s talk about some of the foundational steps you should take early on in order to ensure you’re set up for success with your larger goals.

Step 1 – Get your business in order

“Do you have the best business entity structure for your business and your personal tax strategies? Are you looking to sell your Amazon business? Do you have your business banking accounts separate from your personal accounts? Are you carefully managing your business finances so that they do not co-mingle with your personal accounts? These are all important questions to address because they will play a vital role as you navigate the remaining steps and prepare to sell your Amazon business.

Step 2 – Get your accounting systems in order

Next, you want to ensure that you have your Amazon accounting set up to give you good information to manage your business and hold up to due-diligence scrutiny. Luckily these two goals are compatible, and you can use modified cash or accrual accounting to record your revenue and your inventory/Cost of Goods Sold. By matching the income and the Cost of Goods Sold in the proper periods on your P&L, you will be getting the gross margin calculation you need to understand your business’ profitability. This is how your potential buyer will want to evaluate your finances, too.

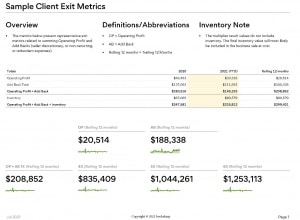

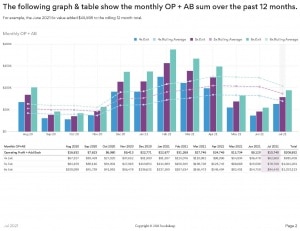

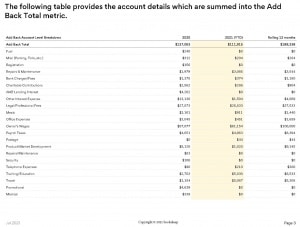

Often, when our clients get ready to position their business for sale, we create a new P&L report to monitor the business valuation. This type of reporting segregates the Add Backs on the P&L so a potential buyer can see the items that you as the business owner can claim for your tax deductions but may not be required for operations for the new owner. For example, if you like to travel to a couple of conferences each year, you can deduct this as a business expense on your taxes. However, the new owner may choose not to attend conferences. This conference travel would be “added back” to your bottom line. Add Backs are important because your business value will be based on the Operating Profit + Add Backs. Once you have determined this number, then you can apply common multiples to be able to determine the potential sale price of your business. This gives you a starting point for understanding your business valuation.

Step 3 – Protect your assets; mitigate your losses.

You also want to ensure you have taken care to mitigate financial losses and protect your assets. For example, have you properly managed your Sales Tax liability? What about your intellectual property; do you have patents, trademarks, copyrights, etc. secured? Do you have nondisclosure agreements and noncompete agreements in place for your team?

Step 4 – Review your profitability.

Once you understand your numbers, what can you do from a profitability perspective to improve your bottom line? Can you cut unnecessary expenses, such as subscriptions, that you no longer use? Can you look at your products and determine which ones are taking your cash but selling slowly or at a low margin? Maybe they should be removed from your portfolio so you have cash to buy better performing products.

Step 5 – Improve your operational efficiency.

Operational efficiency can also be a source for financial improvement. What can you hand off to your team? Are those processes documented so your team can operate independently? A business is typically more valuable if it can function without you. And you will enjoy running a business more if you are not always overwhelmed and behind. Processes and true delegation give you that freedom to focus on your business. It allows you to run your business and not the other way around.

As you can see, when you focus on these areas—profits, processes, and your people, you are building a business that you will enjoy working in as well as a business that is more appealing to sell. It turns out that the shortcut is to do it right from the start.

Leave a Comment