Unlocking the secrets of profitability in your ecommerce business requires a special understanding of your financial statements. One report in particular, your balance sheet, provides 5 driving profitability forces to keep your eye on. So, let’s discuss them and how they can impact your profit and your business.

The 5 Drivers

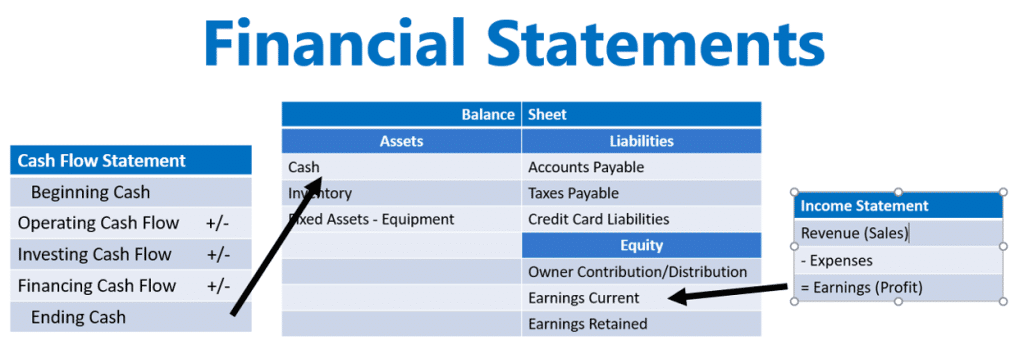

Picture your financial statements as a roadmap guiding you through the intricate terrain of your business. Just as Keith J. Cunningham puts it in The Ultimate Blueprint for an Insanely Successful Business, the Cash Flow Statement and Income Statement act as street maps, offering detailed insights, while the Balance Sheet serves as the world atlas, providing a panoramic view of your enterprise.

1 and 2: Revenue and Expenses

Within the Income Statement lie two pivotal drivers: Revenue and Expenses. Revenue, the lifeblood of any business, can be optimized by aligning with the 5 Core Needs identified in the Sales Level of the Fix This Next Assessment, which you can take for free here. These needs encompass Lifestyle Congruence, Prospect Attraction, Client Conversion, Fulfillment of Commitments, and Collection of Commitments.

To understand more about these needs, you can read my Fix This Next – Sales Level Blog and pay attention to frequency of purchases, repeat purchases, pricing, size of transactions and opportunities for upsell when looking at Prospect Attraction and Client Conversion.

When analyzing expenses on the Income Statement, looking at COGS is imperative along with Cost of Sales, Advertising Expenses and Fees imposed by sales platforms. Make sure to look at overhead and interest costs to make sure they aren’t eating away at your profit margins.

3: Receivable Days

Navigating the terrain of Receivable Days on your Balance Sheet can be challenging, as payment terms are often dictated by platforms. Nonetheless, optimizing these terms as much as possible is key to maximizing cash flow efficiency.

4: Inventory Days

Inventory management emerges as a critical driver demanding attention. Assessing reorder frequencies, negotiating favorable terms with suppliers, and scrutinizing hidden costs are imperative steps. Collaboration with suppliers as strategic partners can yield dividends, leading to improved inventory costs and enhanced profitability.

Working from the Profit First perspective, we look start with the top 20% of sales (dollars and orders) to ensure they are achieving an appropriate gross margin. If not, we start working on areas that can be improved.

5: Payable Days

Extending Payable Days offers a strategic lever for optimizing cash flow. Negotiating extended payment terms and exploring financing options can provide breathing room, provided debt is utilized sparingly and with a clear understanding of its impact on returns. To save your personal credit, do not take risks with debt when you’re unsure of making a return.

Whether you’re grappling with cash flow challenges or seeking to understand how to grow your profitability, we are here for you! Reach out to the bookskeep Team and start forming your financial plan today!

If your ecommerce business isn’t where you’d like it to be in terms of profitability, check out my book, Profit First for Ecommerce Sellers. It answers important questions about how to implement Profit First in an ecommerce business. Take control of your money and your business, and put Profit First to work for you!

You can also sign up for the Profit First for Ecommerce Sellers Online Course. As a Mastery Level, Certified Profit First Professional, I will teach you why Profit First works so well for ecommerce businesses and the particular challenges for businesses that have physical products requiring inventory management. You will learn how your behavior drives your money management habits for your business and how you can set up your business bank accounts to work with your habits.

Check out all our ecommerce accounting and profit advising services here!

Leave a Comment