Just do it. Swallow your pride, and use the GPS for directions! We all want an easy trip so we can enjoy the ride. The best way to make sure that happens is to follow a proven path. You’ll be able to prepare for obstacles that might slow you down like accidents or slow-moving traffic, find the fastest routes, or choose an optional road if you’d like to take a scenic route. Profit First is my favorite way to navigate the financial journey because it will allow you to do all of these things and ensure that your gas gauge never hits E.

Choosing the Best Route

I love using Profit First as my guide because I don’t have to change everything about how my business runs to use it. The method works with your behavior, not against it, and gives your accounts a more meaningful purpose than just being where you recycle your cash. Profit First is based on an economic principal called Parkinson’s Law, that tells us we’re going to use what’s available to us until we don’t have it anymore.

Profit First also flips the accounting formula from Sales – Expenses = Profits, where Profit is simply your “leftovers”, to Sales – Profits = Expenses. With this simple change, you set aside money for the Profit for each dollar collected so you can ensure you spend what you must for operations, and no more.

This method is also the best way to get an instant dashboard by simply looking at your bank account balances. We discussed the importance of dashboards in the previous blog. By using the dashboard created by setting up Profit First, you’ll have the benchmark numbers you need to create a financially successful business for the long haul.

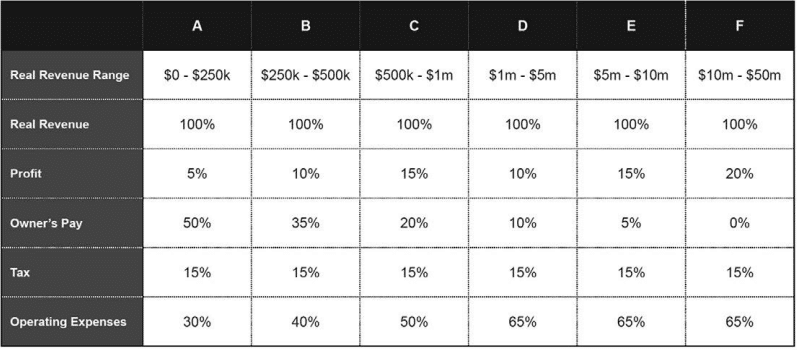

The benchmark numbers outlined in my book, Profit First for Ecommerce Sellers, allow you to compare your numbers to the thousands of successful businesses.

Understanding your current financial situation and how it compares with successful businesses can show you areas to improve. The cash reserve, you build using this method is a bonus for these uncertain times!

Counting Down the Miles

While I encourage you to read the book to understand all the nuances of Profit First, I also encourage you to start. When we coach our clients, we see the most success when we take it slow. We recommend a “beach entry” as opposed to diving in from the cliff. A full implementation of Profit First consists of at least five accounts typically. If cash is constrained at all, and let’s face it, it most always is, that can hamper your ability to put the full system into place immediately (the cliff dive approach).

So, give yourself the time to learn this system slowly so you can fully understand it and not create a cash emergency in your business. Here is how the beach entry works. First of all, you most likely have an operating checking account. That is where your deposits will be made and it’s where most of your expenses will be paid, probably what you’re doing already.

I recommend you create two new accounts to get started: a separate checking account for your inventory and a business savings account for your profit. Separating inventory is important because it has its own unique cash flow pattern, which is much more sporadic than your operating expenses. Operating expenses usually recur monthly, quarterly, or annually.

Inventory will vary based on sales, seasonality, minimum order quantities, etc. By removing the less predictable inventory from your operating checking account, you can start to learn the cash flow patterns of both accounts more easily.

Once your accounts are set up, the flow is fairly simple. When you receive a deposit, determine the cost of goods sold, and the value of the items sold and move that money to your inventory account. Those funds will grow and will be used to pay for your next order from your supplier. Then look at the amount left from that deposit and move one percent to the profit account. Deposit – cogs = Real Revenue * 1% = Profit allocation. The remaining balance is used to fund your operating expenses.

That’s the basic flow of the cash. Your challenge is to understand this flow in the first few months and to focus on cutting operating expenses so you can add more funds to your profit account. The benchmark chart above gives you guidance about the optimal level for our profit account. After you get this dialed in, then consider adding your tax and owner-pay accounts. You may need to do them one at a time and you may need to start with a low percentage and build up.

To get the full outline of this quick start method, check out our quick start guide for detailed instructions. While you may not be able to see the full journey ahead at the start, I know with certainty that you’re much more likely to reach your destination if you ensure your cash flow system is working with your behavior using Profit First.

Click here to watch Cyndi explain the Financial Road Trip in a short 30 minute video!

Interested in Profit First?

You can also sign up for the Profit First for Ecommerce Sellers Online Course. As a Mastery Level, Certified Profit First Professional, I will teach you why Profit First works so well for ecommerce businesses and the particular challenges for businesses that have physical products requiring inventory management. You will learn how your behavior drives your money management habits for your business and how you can set up your business bank accounts to work with your habits.

Check out all our ecommerce accounting and profit advising services here!

Do you know about Cyndi’s new book?

Motherhood, Apple Pie, and all that Happy Horseshit

“You’re about to discover the recipe for successful momma entrepreneurs.”

Business is Personal

As a Mom, you can have it all and it’s better when you do. Using your personal values to create the business of your dreams. By the end of this book you’ll be confident in designing a business that supports your family and yourself. Order Now!

Leave a Comment