Pay Yourself as an Ecommerce Business: One of the key objectives of owning a business is to ensure you can pay yourself. We frequently receive inquiries about when and how much you can pay yourself. Thankfully, Profit First simplifies this process into a straightforward math problem. So, prepare your pencil, because we’re about to delve into the details of paying yourself as an ecommerce business.

How Much Do I Pay Myself

To determine “how much” you need, start by assessing your personal income requirements. Calculate the amount needed to cover your essential expenses, such as mortgage/rent, utilities, food, insurance, and others. If you don’t have a specific number in mind, review your bank statements and create a quick budget based on your monthly expenses.

Consider any quarterly or annual expenses and convert them into monthly equivalents to get a comprehensive overview. However, keep in mind that this budget reflects your current comfortable lifestyle and covers necessary expenses, rather than your ideal or dream lifestyle.

Additionally, contemplate if you can allocate additional funds for “extras” like family vacations, retirement savings, or setting money aside for car repairs or a new vehicle. While you may need to incorporate these expenses into your plan a few months down the line, having these figures in mind is helpful. We provide a simple personal budgeting tool that can assist you in considering and organizing these expenses effectively. Click here to download the tool.

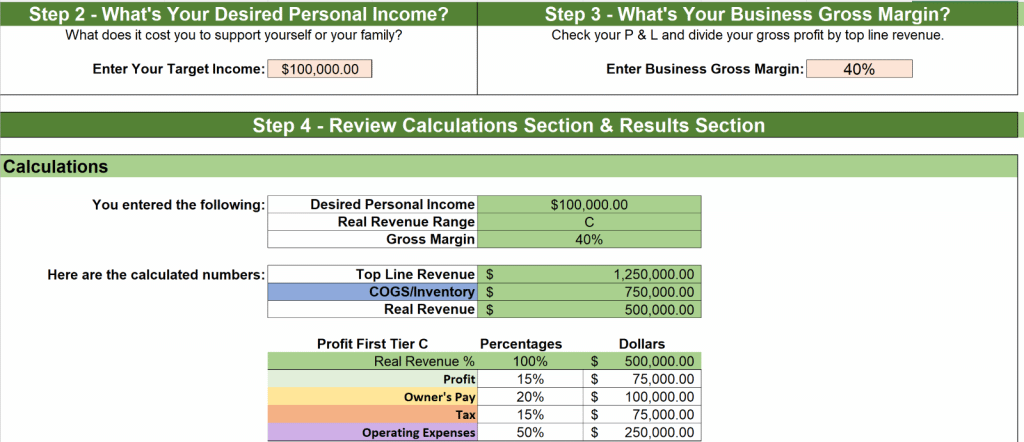

Let’s move on to the second step. In this step we will reverse-engineer your profitability using some Profit First formulas and your information from your business financials. The best way to understand these formulas is to look at a couple of examples. Let’s assume that you would like to pay yourself $100,000 each year. Let’s also assume the gross margin in your business is 40 percent. With just these two pieces of information, we can do a quick reality check to determine if your business is in a position to pay you at this level.

Based on Profit First formulas for a healthy business, we can see that with a 40 percent gross margin, your top-line sales or top-line revenue will have to be at $1.25 million. This figure will mean $750,000 is going to buy inventory and you have $500,000 to cover all other aspects of your business. This includes your profits of $75,000, Owner Pay that you need of $100,000, Taxes at $75,000, and all other operating expenses, including advertising for $250,000.

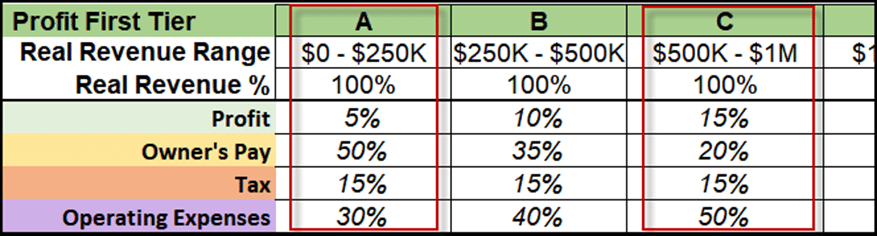

You may look at this and say how do you come up with these numbers. These numbers are based on the research that Mike Michalowicz presented in his book, Profit First. The table below shows, once you have calculated your “Real Revenue” range (this is the number after you have paid for your inventory and other costs related to your products), how your business expenses should line up in the main categories as your business grows its Real Revenue. Our example above puts us in the Profit First Tier C shown in the chart below.

A key component here is that this model is for a healthy business. I see it reported all the time that businesses operate with less profit or owner pay etc. You can do that, but Mike looked at thousands of businesses and built the model based on those that were serving their owners and had longevity. We assume you want to build a healthy business.

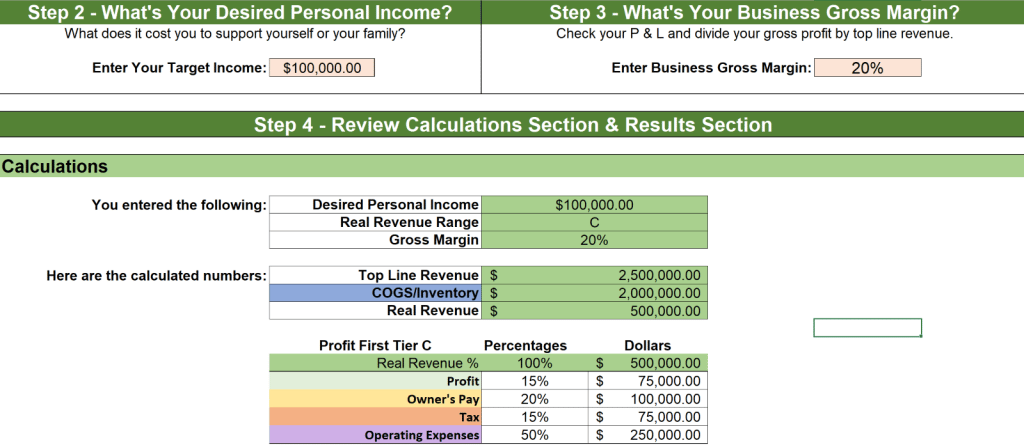

Let’s look at one more example so you can see how you can change an assumption and land in a different spot. We will keep our Owner Pay at $100,000 and only change the Gross Margin down to 20 percent. You can see from the chart below that lowering our gross margin has a huge impact on our expected sales. The first example had a gross margin of 40 percent that equated to Tier C in the Profit First Chart and we had a Top Line Revenue of $1.25 million. The second example, using 20 percent moved us back to Tier A in the Profit First Chart with a Top Line Revenue of $2.5 million. That means your sales have to double to get to the same place with our Owner Pay.

Access our Owner Pay Calculator to input your specific numbers and gain a clear understanding of how they influence your ability to pay yourself. Click here to download.

When Can I Pay Myself

When analyzing your numbers, there are important factors to consider. Firstly, if your gross margin is below 30 percent, it’s likely that your business will face cash flow challenges. Developing a plan to improve your margins will make implementing Profit First and paying yourself more attainable. Businesses operating below the 30 percent margin often rely on debt to sustain their cash flow.

Secondly, it’s crucial to assess whether achieving the required level of sales is feasible. Take an objective look at your situation and avoid overly optimistic expectations. Failing to meet your family’s budget expectations can lead to significant stress.

Additionally, evaluate your confidence in the gross margin you’ve projected. If you’ve maintained up-to-date bookkeeping and are utilizing the accrual method, at least for revenue and cost of goods sold (COGS), you’ll have a suitable gross margin figure for this analysis. If not, refer to our article on accrual vs. cash to understand the importance of this approach in comprehending your business’s profitability. Click here to download.

Finally, consider your cash position. As you are planning your paycheck, can your business afford to take the cash out of the business? To ensure consistent availability of funds for your personal pay, consider setting up a dedicated bank account called “Owner Pay.” This allows you to efficiently prepare your business and ensure sufficient cash flow to meet your ongoing needs.

Before relying on a paycheck to fulfill your personal needs, ensure you fund your Owner Pay account to the desired level. By consistently contributing to this account for three months, you establish a buffer that provides coverage in case of any unexpected setbacks.

As you can see, paying yourself should not be left up to chance. Your family is counting on you, so take all these considerations into account as you make this important decision for both your business and for your family.

Leave a Comment