What’s your greatest challenge as an ecommerce business? I always ask this question as I speak with potential clients and other ecommerce sellers. The resounding answer is most often—Cash Flow! My guess is it’s the same for you. Cash flow is generally one of the greatest challenges because it fluctuates so much, just by the nature of ecommerce business. My response to them? Cash flow is really a symptom they must respond to; it is not a root cause. One of things I love most is helping sellers to understand this concept.

While we must manage cash in an efficient and effective manner, the driver for cash flow issues typically comes from pricing and margin health issues, or from out-of-control spending. In other words, are you charging too little for your product or does it cost too much to make your product for the price you can expect in the market? If you understand the issues from either the sales or profit levels in the business, you can typically resolve your cash flow problem.

Depending on the economic tides at any given moment, cash flow can become an even greater concern. Let’s go over a few tips that can help you prepare for those inevitable ebbs and flows in uncertain times.

Evaluate Your Operating Expenses

This is a good first step for ecommerce accounting. Pull your last three months of expense transactions, either from a detailed transaction report from your accounting software, or simply review your bank and credit card statements. Look at every transaction and mark it as either C, R, or K—Cut, Reduce, Keep. Look at each transaction and assume you can cut it. If you did, how would that change or impact your world? If you can’t let it go completely, how can you reduce it? Nothing gets a pass. Seriously consider how you can survive with less. It’s better that you keep those funds now than to spend that money and then three months from now, wish you still had it. I challenge you to cut $2,000 from your account, which is a typical amount we can achieve with new clients.

Look at your Payroll

Are you really getting the production needed from your employees? It’s always tough to let people go, but how long can you keep payroll at current levels if sales drop off significantly? You need to be working on preserving the business, not saving every job unless you have months of cash reserves.

Examine Your Margins

What can you do you increase your margins? Is there a way to increase prices? I’m not suggesting price gouging; but have you really looked at pricing lately? If not, see what you may be able to adjust. Look at your product costs and determine any changes you can implement to reduce those costs.

Explore a Line of Credit

If your business has been operating steady with good margins for a couple of years, your local bank or credit union may be willing to extend you a line of credit. Remember, it’s always better to ask when you’re in good shape, financially. Don’t wait until your sales numbers have dwindled and you’ve used all your reserves. Hold that line of credit as your rainy-day fund. It’s not an open checkbook; it’s there to be your life support should you need it, when all else fails.

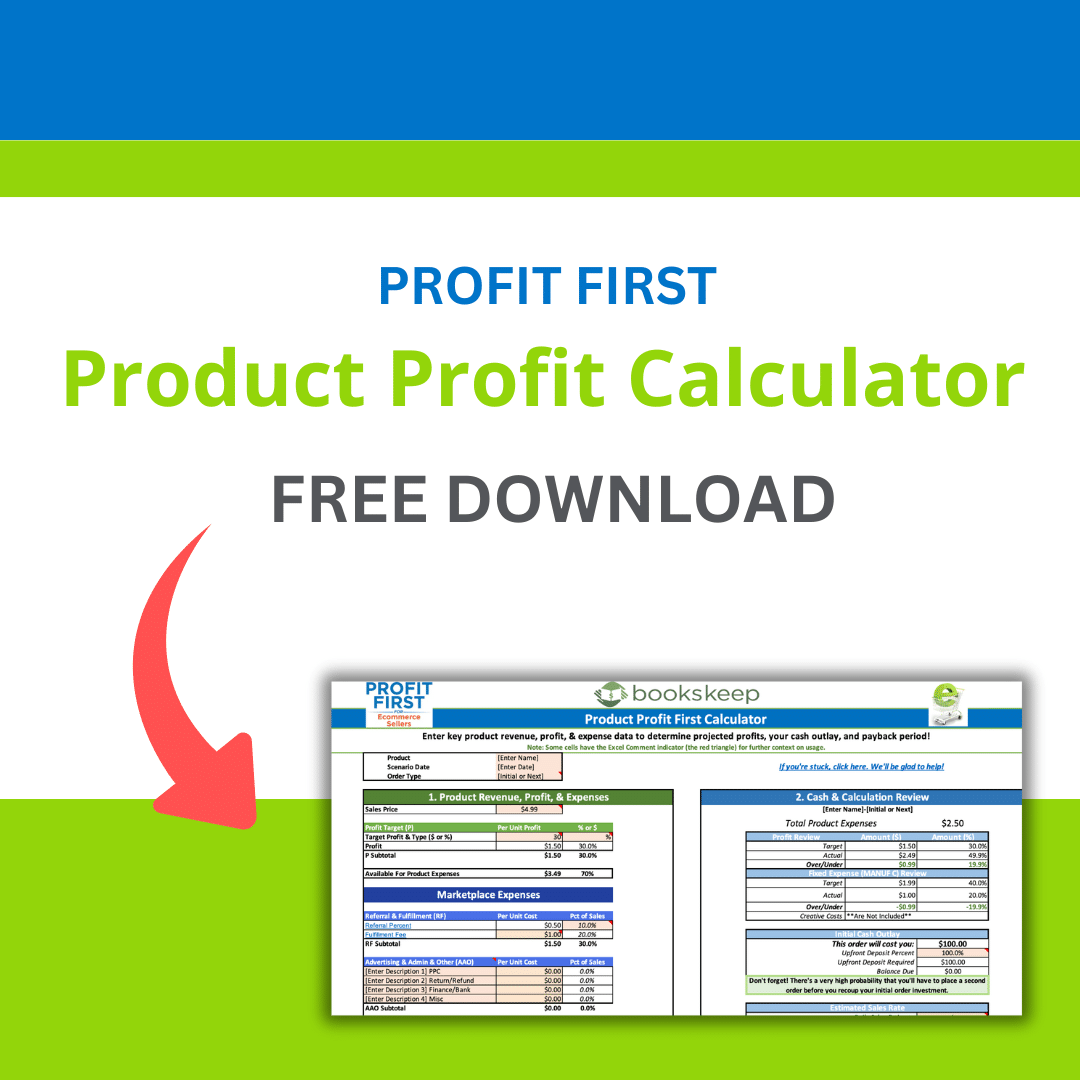

Build Your Reserve Fund with Profit First

If you have implemented Profit First in your business, you should have reserves set aside. Keep them set aside. This reserve account could be what gets you through the down times when cash flow is slow. Remember that having little or no debt and an emergency fund is critical to long-term success. Use your reserves judiciously.

If you haven’t implemented Profit First and want peace of mind during uncertain times, get started with the tips above and then start your profit account. You can find more on Profit First at the bookskeep blog site.

Interested in Profit First?

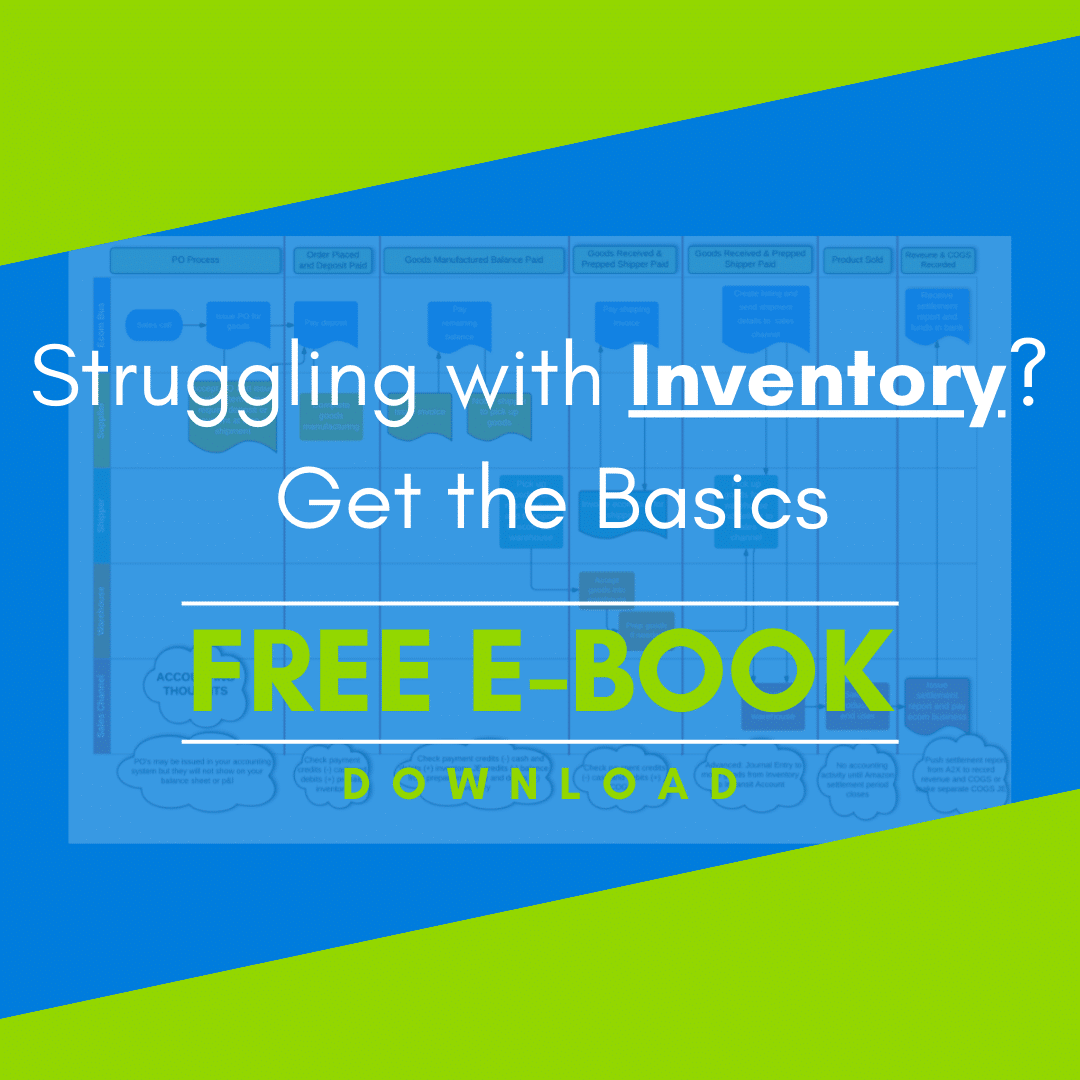

You can also sign up for the Profit First for Ecommerce Sellers Online Course. As a Mastery Level, Certified Profit First Professional, I will teach you why Profit First works so well for ecommerce businesses and the particular challenges for businesses that have physical products requiring inventory management. You will learn how your behavior drives your money management habits for your business and how you can set up your business bank accounts to work with your habits.

Check out all our ecommerce accounting and profit advising services here!

Leave a Comment