What do you do when something doesn’t go as planned and you end up with Inventory that has to be destroyed or it is lost? Or perhaps you have returns that are sellable and you will list them on ebay or resend them to Amazon? Or even donate them if they have slight damage but they are still useable. This past January, bookskeep teamed up with our good friends at InventoryLab to present a webinar addressing these very issues. We had lots of questions about how to handle these situations from an accounting perspective and from within InventoryLab. Read on to learn more about accounting for inventory!

I’d like to give you a general explanation about how it works from an accounting perspective. Jeff Campbell, Customer Engagement Coordinator at InventoryLab is going to add the steps needed to handle these instances in InventoryLab.

Inventory from an Accounting Perspective

As long as you have paid for inventory and it is available for sale, it sits in an inventory asset account until you sell it. You are trading cash for inventory. As long as you have cash or the goods, you are holding assets that would show up on a balance sheet and not your Profit and Loss statement. At the point you sell the inventory, it leaves the inventory asset account and moves over to the cost of goods sold account on your P&L. This happens for two reasons. First, you have sold the inventory, which generates revenue and it ultimately puts cash in your bank account. To determine the profit you made on that sale, you have to subtract the cost of goods sold (the buy cost of your inventory) from your revenue. This allows you to see your gross margin on the sale. InventoryLab automates this for you at the time of sale, based on the sales information in Amazon and the buy cost information you add to each item in Inventory Lab.

Best Practice for Your Buy Costs

It is a best practice is to look at your buy costs each month to ensure you have populated that information in InventoryLab. When we have challenges with our clients’ COGS numbers, it is typically because they have forgotten to add the buy cost in the software. Checking this each month will ensure that you have good numbers. Now when everything goes as planned, there is not much for you to do because InventoryLab does it for you.

When you have one of these scenarios:

- Amazon didn’t receive my full shipment or my full shipment was checked in and then a portion of it was lost.

- An item is returned from my customer because it is damaged and is now unsaleable and must be destroyed or donated.

- An item is returned from my customer and it is in good condition to send back to Amazon for resell.

- An item is returned from my customer and it is in good condition and I will sell on ebay or another platform.

…you need to help the software deal with the unusual circumstance.

Your Questions about Inventory Lost at Amazon

Q. When you send in your inventory and it is never received at Amazon, perhaps because of a shipping issue, do we add it manually in IL in the unlisted inventory section and IL reports will include it as an expense?

- If the item is returned to you, then it is still an asset that you have to sell. It will show up in your IL Inventory Valuation Page if Amazon has received it, but if not then it won’t be listed on any of your inventory pages or on the Inventory Valuation Report. You should resend it to Amazon if it is sellable.

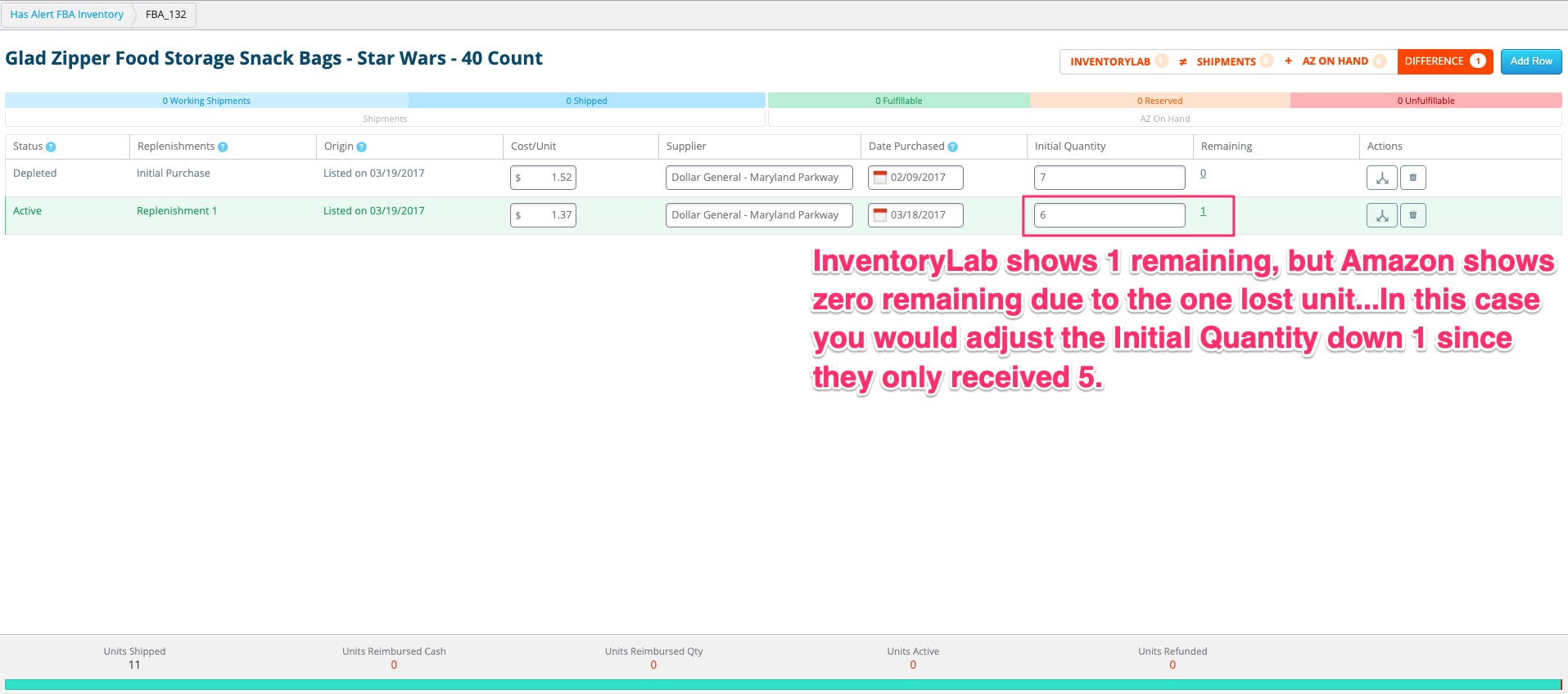

- If the item is lost and not returned to you, then you would have to add it into Other Expenses in InventoryLab to account for the loss.In this case you would also see an alert on your inventory page since what you show in InventoryLab as the initial quantity sent in isn’t the same as what Amazon has received. You will also have to manually adjust the Initial Quantity amount on the Inventory>FBA or Merchant page (whichever channel you listed it under) so that InventoryLab is showing the same amount sent in as received.

Q. How do we account for inventory lost by Amazon?

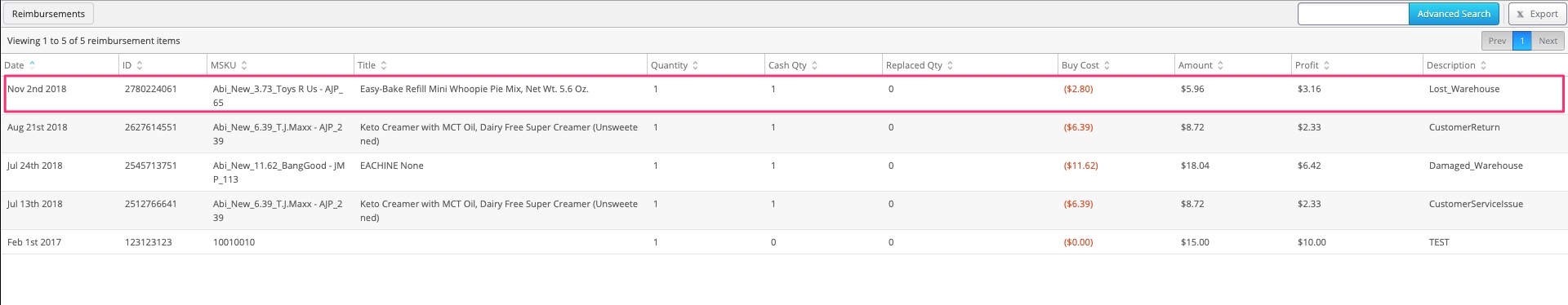

- Once you confirm the item is lost, you will file a reimbursement claim. IL automatically handles the reimbursement under Accounting>Reimbursements.

Your Questions about Returns

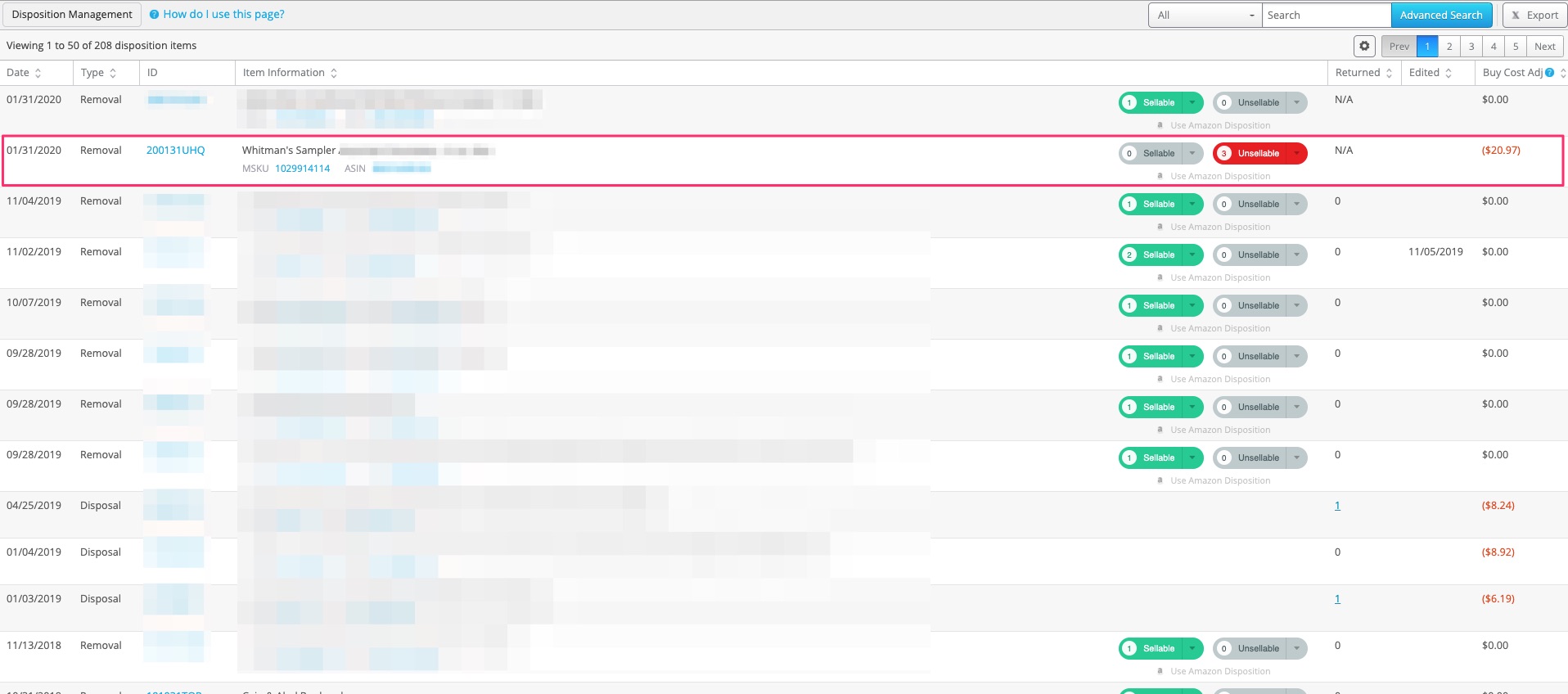

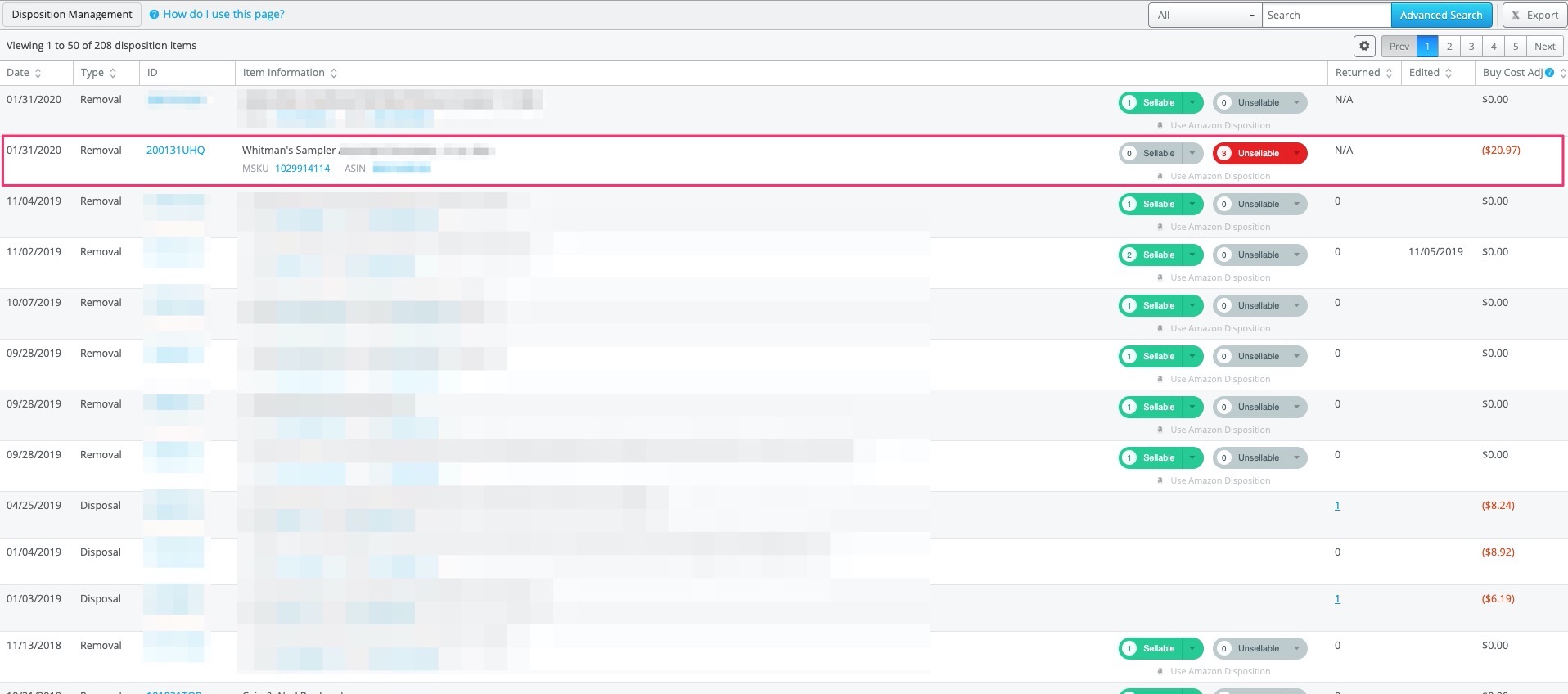

Q. If we note an item as unsellable on removal order in InventoryLab, will this impact the profit and loss statements?

- If you mark it as unsellable on the disposition management page, then yes, it is written off as a cost in the COGS section of P&L.

Q. Are there additional entries needed (beyond Amazon generated entries) when discarding inventory for proper accounting?

- No, if it was marked as unsellable, then nothing else needs to be done

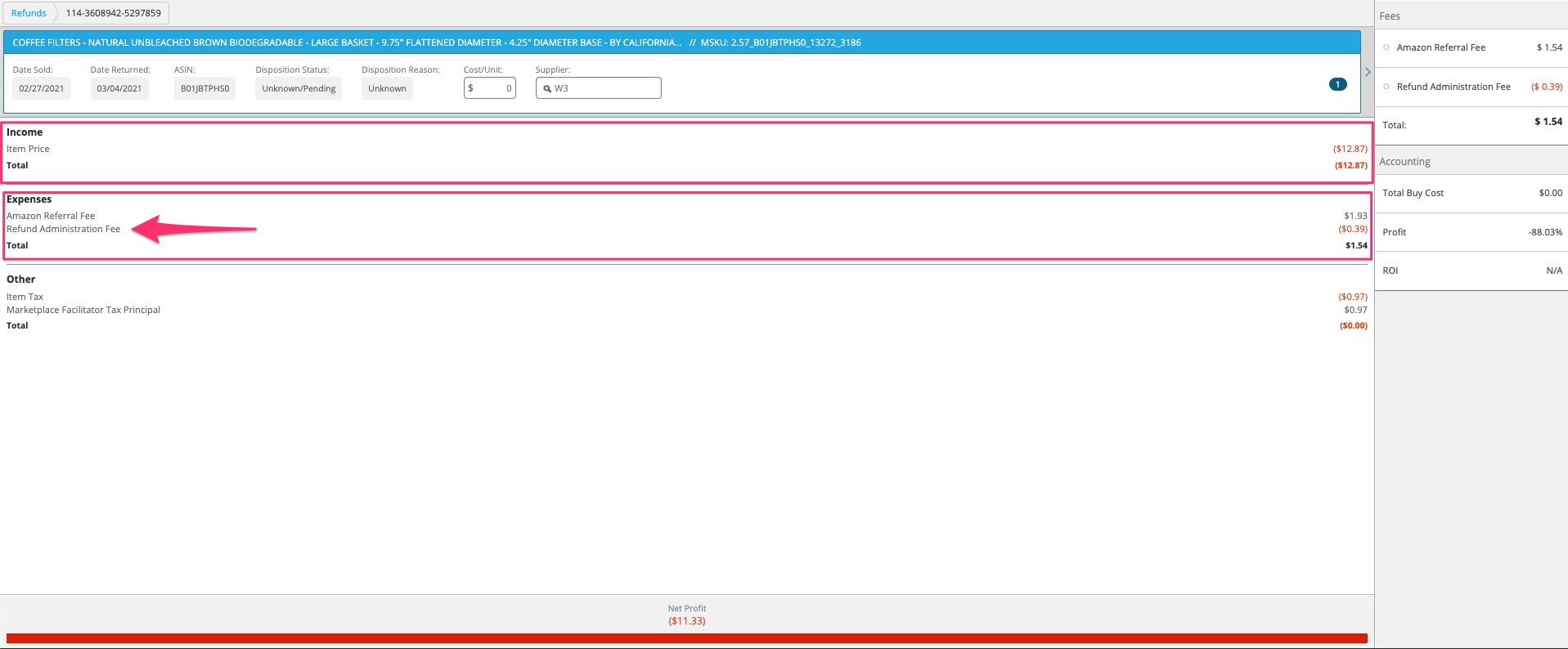

Q. When an item is returned by a customer is the total amount turned into a loss?

- Basically the sales transaction is reversed because the assumption is that you will be able to sell the item to someone else. The income is reduced and the buy cost (inventory) is increased. The referral fee and sales tax and facilitator tax is reduced but then you are charged a refund administration fee.

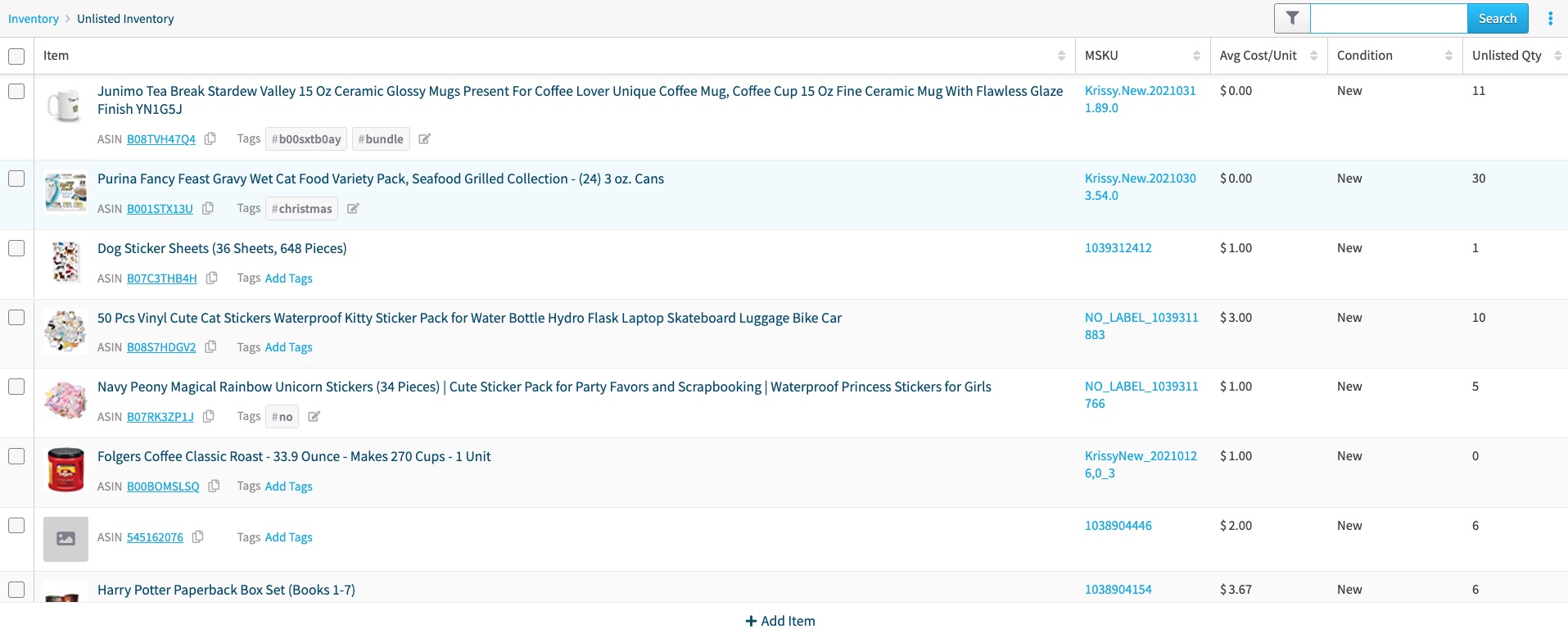

Q. How do you handle cost of goods bought that DIDN’T sell or were never ungated?

- They will remain on your inventory valuation (if they are showing in Seller Central) or in your Unlisted Inventory page (if you were unable to send them to Amazon due to gating as long as you put them there), until you decide to destroy or donate this inventory.

Q. How do you handle items that were damaged at Amazon?

- In Seller Central, prepare a removal order. A best practice is to do 1-2 orders at a time in order to close them out as they occur. Then when it is returned from Amazon, the item or items are removed from the Inventory Valuation report. Once the removal order is marked as completed on the Reports>Removals and Disposals page, the item will display on the Accounting>Disposition Management page. You can then mark it as unsellable and the cost adjustment will happen. This action will expense the items in Cost of Goods Sold of the Profit and Loss report.

Q. How do you account for items where the price tanked and the items are not selling so you have them returned to you because you MIGHT list on ebay, or potentially send back to Amazon?

- In Seller Central, prepare a removal order. A best practice is to do 1-2 orders at a time in order to close them out as they occur. Then when it is returned from Amazon, go into the IL disposition management section under the accounting tab and mark it as sellable. Then add it to Unlisted Inventory under the Inventory tab in InventoryLab.

As you can see, the webinar brought up great questions, and Jeff and I were glad to work together to get them answered for you. If you have other questions, we invite you to check out additional blogs on this and other related topics at bookskeep and InventoryLab!

Interested in Profit First for Ecommerce Bookkeeping?

You can also sign up for the Profit First for Ecommerce Sellers Online Course. As a Mastery Level, Certified Profit First Professional, I will teach you why Profit First works so well for ecommerce businesses and the particular challenges for businesses that have physical products requiring inventory management. You will learn how your behavior drives your money management habits for your business and how you can set up your business bank accounts to work with your habits. Contact bookskeep today for more information on ecommerce accounting and bookkeeping.

Leave a Comment