For anyone who knows me, you know that I love visiting with folks about their numbers! It’s always a hot topic. I did a 4-part blog series last fall about how to get the most out of your financials, and it was very well received by our industry audience. In fact, it led me to host a webinar on knowing your numbers and reading your financial statements. I wanted to offer a platform for folks to come in, learn how I approach financial statements, ask questions, and get real-time answers.

The webinar, Know Your Numbers, provided attendees with solid information that they could take away and use in their business right away. I wanted to share this treasure trove of information, so my team and I have broken the webinar into four parts that we will be sharing over the next four weeks. This week’s blog will start us off with the foundations of every business!

Back to Basics—Business Types and Accounting Methods

How well do you understand the different business types, including your own? What about the accounting method you’re using? Do you know why you selected that method and what it really does for you? At the end of this week’s video, my hope is that you have a clearer understanding of both.

Here’s what we’ll be covering in this week’s video—

Business Types

In order to know the type of business that’s best for you, you need to understand what each business type means. There are four primary options:

Sole Proprietor or LLC (Limited Liability Corp) – If you are a sole proprietor or an LLC, your taxes are going to be reported with a Schedule C on your Form 1040. Owner pay is going to be on your balance sheet and not on your P&L, and you’re not going to see any taxes recorded on your books.

LLC with S Election or C Corp – If you are an LLC with an S election, your CPA will file business tax returns using a Form 1120 S and Schedule K with your Form 1040. On both of these types of entities, the owner has to be paid a reasonable salary, and it must show up on the P&L.

Understanding the type of business you have will help you navigate and understand your financial reports. Also note that if you’re comparing your bottom line with someone else, their business type may be different and you may be comparing apples to oranges.

Accounting Methods

The other important piece of context here is your accounting methodology. There are two primary types of accounting and a third type that is less used, although it is what we use here at bookskeep because it works well for small businesses, particularly ecommerce businesses with inventory.

Cash Accounting – Most businesses start out using the cash accounting basis, and a lot of service businesses can operate fine using this method. Cash accounting means that when your revenues hit the bank or when your expenses come out of the bank, that’s when the activity is recorded into your books. Now that’s useful from the standpoint of understanding what your cash balance is, but the place where it gets challenging is when you’re purchasing inventory.

Accrual Accounting – Your CPA will advise you when you need to switch to this accounting method. Accrual accounting puts the income and expenses in your P&L, in the proper month where they happened.

Modified Cash Accounting – This is the method we use here at bookskeep. It allows us to use the accrual method for the items that I like to see recorded in the month they occurred, and the cash method for the items where that doesn’t matter as much. It’s a blended approach where you do accrual for the revenue and cost of goods sold portion of the P&L and cash for the expense section. This matters because you really want to understand what your profit is at the gross margin level. You also want to be able to understand trends in your business, which is important if you’re building a business to sell at some point.

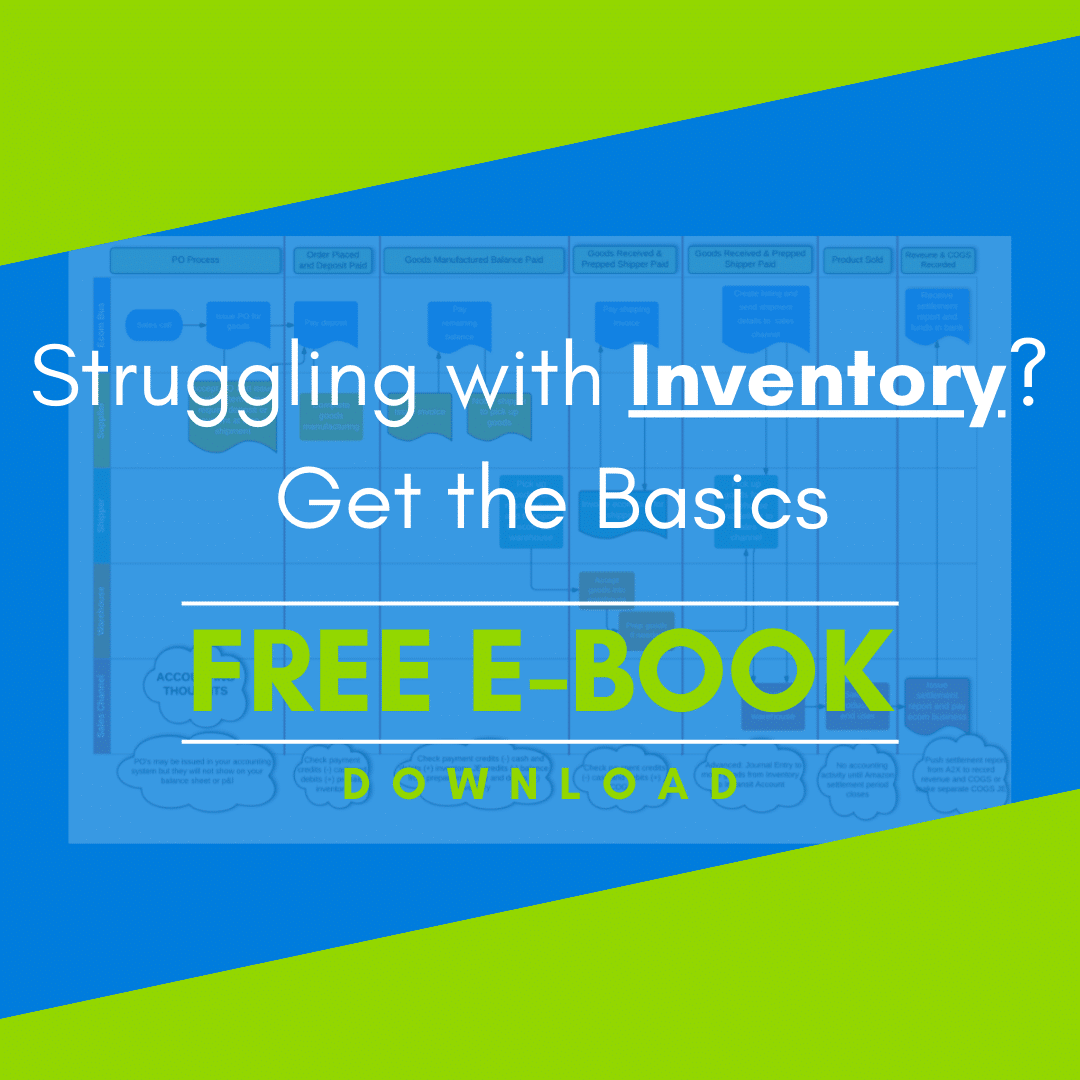

Inventory and COGS

I want to dive just a little bit into the inventory and COGS piece because that is the piece that I think a lot of folks have trouble with when they purchase inventory that they anticipate selling at some point.

Basically, you are trading cash for an asset that you’re going to turn that asset into something to generate revenue. So, when you actually buy inventory, I refer to it as cash that you can’t spend. But what do you do with it?

To get the full content of today’s topics, please watch Part 1 of our video blog series, Back to Basics—Business Types and Accounting Methods. Watch here and check back for next week’s video blog, What to Review on Your P&L.

Interested in Profit First?

You can also sign up for the Profit First for Ecommerce Sellers Online Course. As a Mastery Level, Certified Profit First Professional, I will teach you why Profit First works so well for ecommerce businesses and the particular challenges for businesses that have physical products requiring inventory management. You will learn how your behavior drives your money management habits for your business and how you can set up your business bank accounts to work with your habits.

Check out all our ecommerce accounting and profit advising services here!

Leave a Comment