Tax season is here again, bringing with it a load of forms and paperwork. Despite the hassle, accessing the necessary IRS forms and instructions is relatively straightforward through their website.

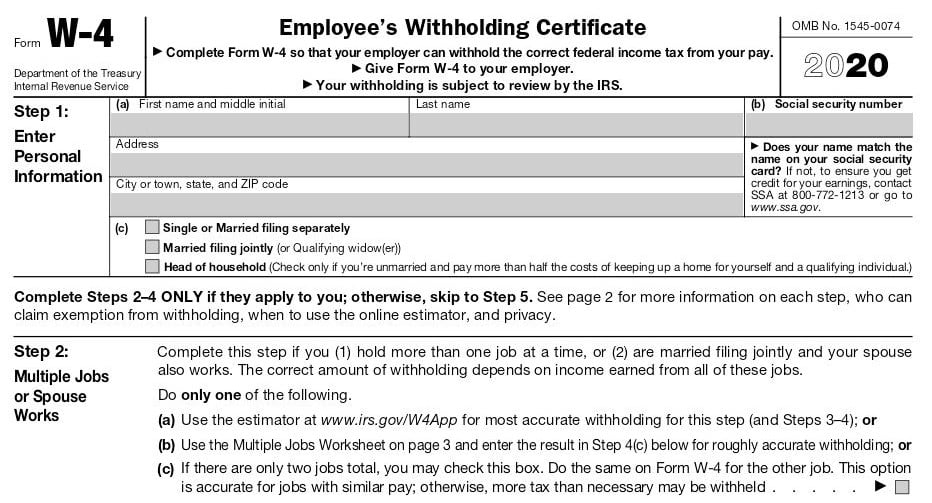

The new Form W-4 2020

Although we don’t provide ecommerce tax services, our bookskeep team does stay apprised of changes in the basic forms so that we can help our clients stay informed about changes that may impact their business. One of the changes recently released is the redesigned IRS Form W-4, Employee’s Withholding Certificate.

As a business owner with employees, you’re familiar with the W-4 form used to withhold federal income tax from their wages. The IRS released a new Form W-4 on December 31, 2019, to accommodate recent changes in the medical expense deduction floor. While the previous form can still be used, the new one is recommended for employees hired in 2020 or those making withholding changes during the year.

Many of my CPA colleagues recommend employees use the IRS’s Tax Withholding Estimator to prepare the needed information at home because previous tax returns can be helpful. Then the employee will be ready to complete the form at ease at your workplace.

Below are just a few of the top Q&As taken from the IRS website:

Why redesign Form W-4?

The new design reduces the form’s complexity and increases the transparency and accuracy of the withholding system. While it uses the same underlying information as the old design, it replaces complicated worksheets with more straightforward questions that make accurate withholding easier for employees.

What happened to withholding allowances?

Allowances are no longer used for the redesigned Form W-4. This change is meant to increase transparency, simplicity, and accuracy of the form. In the past, the value of a withholding allowance was tied to the amount of the personal exemption. Due to changes in law, currently you cannot claim personal exemptions or dependency exemptions.

Are all employees required to furnish a new Form W-4?

No. Employees who have furnished Form W-4 in any year before 2020 are not required to furnish a new form merely because of the redesign. Employers will continue to compute withholding based on the information from the employee’s most recently furnished Form W-4.

There is a great deal of information on the IRS website about the W-4 form, for you as an employer and for your employees. We recommend that you take some time to visit the IRS website and read up on the changes. Your employees can also learn what the changes mean for them by reading the FAQs. It may sound like a bit of a boring read, but it’s worth the time to make sure you’re in compliance with the latest requirements! And if you have independent contractors working for your company, check out our recent blog about preparing 1099s!

Leave a Comment