Accounting Methods Guide

When it comes to running a successful ecommerce business, making the right financial decisions is crucial. One of the key choices you must make is selecting the right accounting method. This decision directly impacts your financial reporting, tax obligations, and overall business performance. At bookskeep, we understand the complexities of the ecommerce industry, and we’re here to guide you in choosing the perfect accounting method. Experience financial clarity and unlock the potential for long-term success.

The Impact of Accounting Method

Choosing the right accounting method is more than just a bureaucratic requirement. It has a profound impact on your business’s financial stability and growth. Here’s why it matters:

Accurate Financial Reporting:

The accounting method you choose determines how you record and recognize your revenue and expenses. Accurate financial reporting ensures you have a clear picture of your business’s profitability and cash flow, which is crucial for making informed decisions.

Tax Compliance:

Different accounting methods have varying implications for tax reporting. By selecting the appropriate method, you can ensure compliance with tax regulations and potentially optimize your tax liabilities, saving your business both time and money.

Long-Term Planning:

The accounting method you adopt affects your ability to analyze historical data and make projections for the future. Making the right choice allows you to develop effective financial strategies, set realistic goals, and make informed investments.

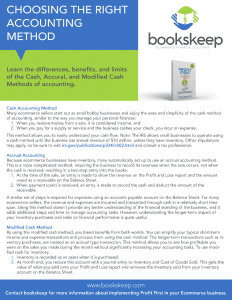

Learn the Differences, Benefits and Limits of the Cash, Accrual, and Modified Cash Methods of Accounting by downloading.

Fill Out the Form Below To

Download Your Accounting Methods Guide